The United States of America is considered to be one of the most powerful countries in the world. It is known to be the land of opportunities which is why people from all over the world are trying their luck to come there.

They have some of the most amazing career opportunities but then again, why is it that most Americans don’t seem to have enough money when it comes to savings for emergency purposes.

Almost every financial experts say that saving for emergency funds are the most important ones then again, it is also something that most people don’t have. Every person is ideal to have at least three months worth of living expenses just in case they lose their job all of a sudden so they could cover bills that they need to pay.

Emergency funds cannot come out of a credit, it is just not the best thing to do since as well as has high-interest loans. Despite knowing all of this, a huge percentage of people in America are still struggling, continue reading to find out why.

No Emergency Savings

There are approximately 33 percent of people in the United States that does not have enough in their emergency funds and most of them are in credit card debts, this is all according to Bankrate and their chief financial analyst, Greg McBride, even said that despite the people’s knowledge regarding the importance of having emergency funds, they still don’t choose to do it since they haven’t really realized that it is real deal and could be a situation they could be part of.

However, some does not have a choice since they have a low-paying job, but then again, being able to save for something unexpected is necessary regardless of how old you are or what you do.

GoBanking, which is a personal finance site, even conducted a study wherein they found out that a normal household in America actually spends almost $60,000 approximately every single year and in that amount, more than $20,000 is for the living expenses.

That just means that when a person loses their job, he or she must have around $20,000 saved up in their bank account to be able to survive for six months. However, they also found out that 38 percent of adults in America have less than $1,000 in their savings, which is obviously not a not good sign.

33 % of people in the United States that does not have enough in their emergency funds

Why Can’t Americans Save Money?

Based on a recent study, it turns out that there are actually a couple of reasons why Americans find it extremely difficult to save money. One of the most common ones is the fact that they choose to upgrade their lifestyle almost every single year.

Since the United States is known for being trendsetters, almost everyone can’t seem to live off of something that is “so yesterday”.

Financial experts also said the FOMO or the Fear of Missing Out phenomenon is too real, it used to be a term referring to Millennials but it is for everyone who is living way beyond their means. They also said they this has got to be the most dangerous path when it comes to money since people would only be saving what is left, even if they are supposed to be saving before they splurge, not the other way round.

These are also the same with people who like to “live in the now” and having that YOLO or You Only Live Once attitude. They believe that it is best to live in the moment and make themselves happy by spending the money they worked hard for the things that they want.

If you think about it, there is actually nothing wrong with splurging, but then again, too much of anything does not lead to anything good. Splurging are often related to impulse buying, which is also something another thing that people should avoid.

CBS This Morning / Youtube

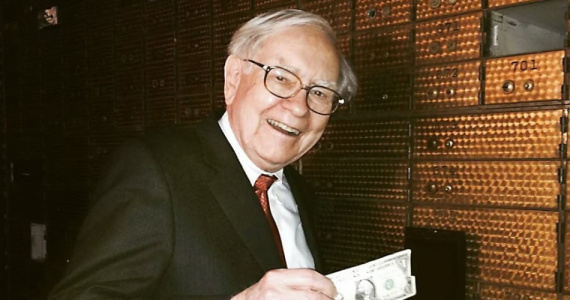

Business magnate Warren Buffet, once said that happiness that involves money is temporary, which why people shouldn’t revolve their lives spending it. However, saving it in order for them to have something when needed is significant. Buffet even compared saving money to oxygen, since it is something that people don’t usually think about, but then needed, it is the only thing they could think of.