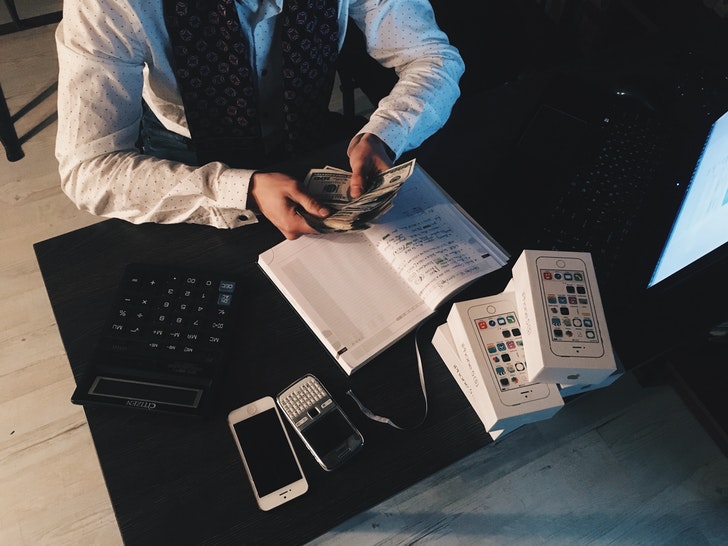

Being patient and working hard in your business or work life can help you become successful, but the truth is, you aren’t successful until you solve the ultimate problem: how to handle your finances. Gen Z and millennials tend to handle their finances on their own with their own adhoc strategies but here are essential some money advice you should never ignore:

Save more than you need to save:

It is important to strike a balance between enjoying your life and also building assets and future financial security and stability. With a clear vision of your assigned budget, emergency savings, and personal expenditures, you can start saving more money than you need to.

After all, there’s no downside to saving too much, but there are many if you save too little. By saving more than you necessarily need to save you can handle emergencies easily and take advantage of opportunities that do come up, such as an unexpected trip or unexpected shopping. You can also incorporate new goals into your planner over time. Saving more also automatically buys you your financial freedom in the future.

Pay off your debts and avoid loans

Pay off any credit cards or other high-interest loans and debts by paying off through little transactions every month or by getting a new job. Studies have shown that paying in little balance can help you gain the confidence to tackle larger debts without disrupting your financial stability. Gen Z specifically chooses to avoid getting a second job and forget that the cost of living is higher forever generation.

A part-time job may sound exhausting and a big responsibility, but it can help you save more money in a shorter time and pay all your dues without the added interest. Furthermore, you should also avoid taking loans. If you wish to take a private loan to clear your college tuition fees, then you should first check scholarship options, grants, and federal loans. You could also fill out the FAFSA (Free Application for Federal Student Aid) to apply for financial aid for your college or graduate school.

Cut down on eating out

Eating out on a regular to weekly basis can really add up to a big sum of spending, even if the meals are not expensive. Instead, you can make your own lunch from home and restrict yourself to only eating out once or twice a month. Avoiding frequent food expenses can also help your body stay healthy and fit, and you can thoroughly enjoy the experience with your friends and family and save money. Making your own lunch gives you more freedom and independence to make your own blend of flavors.

Keep track of your spendings

Knowing where your money goes is the best way to help you with budgeting. Once you see how the cost of early morning coffee or breakfast takeaway adds up over the course of months, you’ll realize that making small and manageable changes in everyday expenses can have a big impact on your financial situation.