Investment In Zume Pizza

Zume Pizza is a start-up company which utilizesrobots in the process of making and delivering pizza. Reports suggest that the company has gotten $375 million investment backing from Softbank, an investment firm.

The pizza company based in California announced the investment in a recent securities filing. While it did not disclose the identity of the investor, Wall Street Journal has reported that the funding was from the Vision Fund of Softbank.

Softbank Vision Fund is allegedly worth $100 billion. The fund gets its heaviest backing fromthe $45 billion payment it raised from Public Investment Fund of Saudi Arabia.

Reports further have it that the bank will still subsequently make an additional $375 million in Zume Pizza. That latter investment would bring the valuation of the company to approximately $2.25 billion. However, neither companies have made any remark about this alleged development.

Zume’s Operations Using Robots

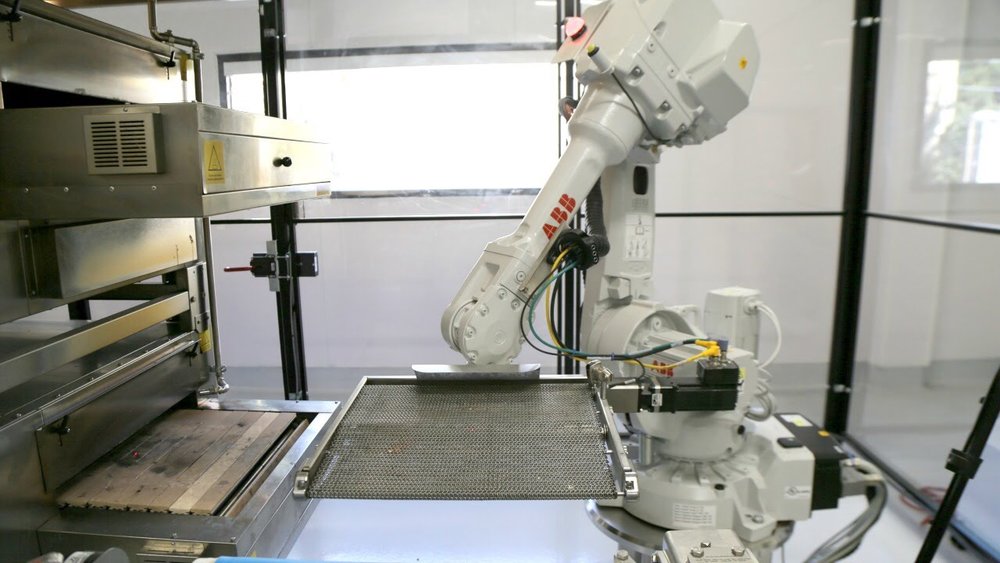

The startup company makes use of a combination of humans and robots to make and also deliver pizza. The work of the robots include squirting and spreading tomato sauce on uncooked pies and subsequently transferring them into the ovens.

Each of the robots cost around $25,000 to $35,000. They are manufactured by ABB which is a global robot manufacturer dealing with production of robots for large manufacturing companies.

Zume Pizza also has plans that includes the operation of trucks that make use of ovens which are remote controlled to heat up the pizzas when they are about to be delivered. The operation of the ovens from cloud implies that the company would be able to bypass the rules that prevent the preparation of food in vehicles that are in motion.

Zume Pizza’s Reach

The first pizza by the company was sold in April 2016. At the moment, the areas it delivers to includes Palo Alto, Menlo Park, East Palo Alto, Atherton, Santa Clara, Cupertino, Campbell, Sunnyvale and Mountain View. All areas are suburbs of California. Zume was founded sometime in 2015 and its mission is to root out the inefficiencies that exist in the U.S. pizza market. The pizza market in the U.S. is reportedly worth $33 billion.

The company uses predictive analytics to decipher the toppings that would have the highest popularity in a particular area. The company also uses the analytics to determine when there would be an increased demand for particular orders based on existing events at that particular moment.

By being able to maximally operate with a minimum staff, this company is championing the next generation disruption. Their disruptive activities are similar to what McDonald’s stood for in the restaurant industry when it first launched.

SoftBank Vision Fund

The aim of the Fund is to invest in the tech sector by taking advantage of the firm’s in–depthtechnology expertise as well as its experience in investment. It is expected that the fund would invest in foundational platforms and businesses. The investment would be in such platforms that the investment bank believes would give room for the next generation of innovation.

The fund is specifically designed to serve as a catalyst for the progress of technology which is in anticipation that it would in turn expand the capabilities of SoftBank and also accelerate its progress. The Public Investment Fund isn’t the only investor in the fund, as SoftBank Group and also Mubadala are initial investors. Other investors include Apple, Qualcomm, Sharp and Foxconn.

SoftBank created this fund because it strongly believes that the next level of Information Revolution is imminent and creating businesses that will aid the attainment of that level requires large scale and long term investment. In addition, it is also expected that the portfolio companies of the fund will enjoy significant benefit from its operational expertise and itsoperations on a global scale.

Also, it already has an ecosystem that contains group portfolio companies such as Yahoo Japan and that would also enable the acceleration of their growth profile. The Fund is expected to be the company’s major vehicle for the realization of its vision for SoftBank 2.0.